Identifying new and emerging cannabis market opportunities takes a lot of time and effort. It is the very important information for you to stay ahead of the curve and it will certainly benefit your business decisions.

CREC offers one stop shop consulting services nationwide from licensing, financing, compliance, legal, and more. Market research is one of the most important tool we use to help our clients. Our Market Research Analyst Mitch Kraemer is up to date everyday with nationwide cannabis regulations so YOU can make the best decision for your business.

Mitch’s Picks is where he shares his valuable research in the industry with you!

In this blog post, you’ll learn the Top 3 Open and Upcoming Market Opportunities. Let’s dive in.

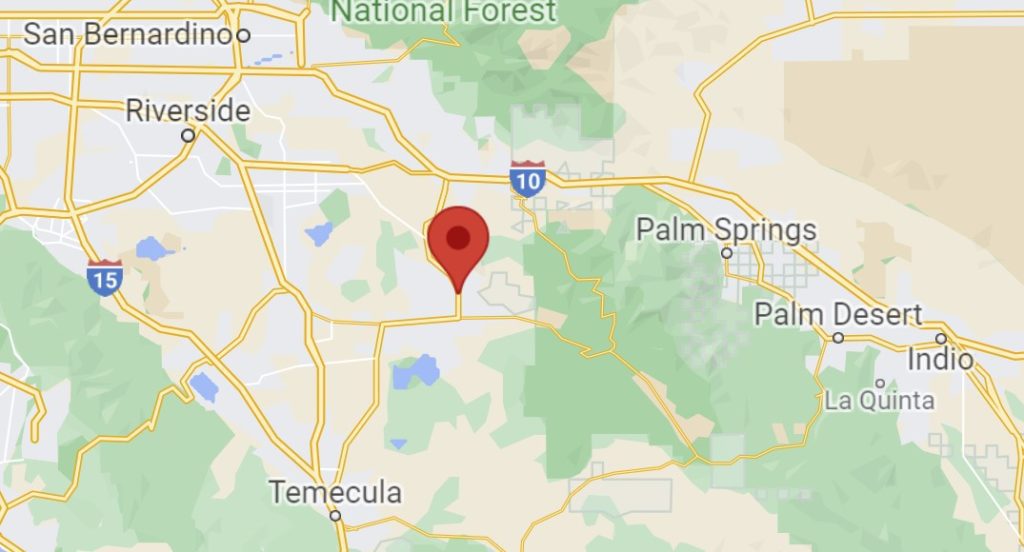

1. Riverside County, CA

Why: Riverside County is one of the most cannabis friendly counties in the state, with open ended application periods and no caps on cannabis businesses and located near the lucrative LA and San Diego markets.

Uses: Indoor and Mixed-Light Cultivation, Volatile and Non-Volatile Manufacturing, Distribution, Retail, Delivery, Testing, and Microbusiness

Application Period: Open Ended

Tax Rate: Tax rate is set by a development agreement with the county.

View Riverside County Real Estate & Regulations

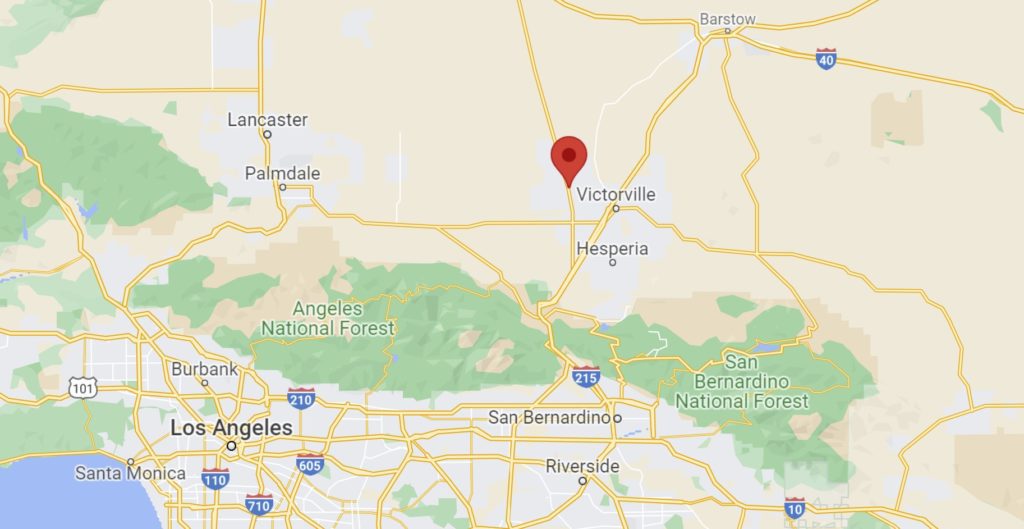

2. Adelanto, CA

Why: Adelanto has an open-ended application period, with extremely competitive tax rates and no caps on non-retail cannabis businesses, making it a great location to open a microbusiness at any time.

Uses: Retail, Cultivation, Non -Storefront Retail, Testing, Manufacturing, Distribution, Microbusiness

Application Period: Open Ended

Tax Rate: Cultivation: $0.415 per square foot of canopy, All other uses: 3% of gross receipts

View Adelanto Real Estate & Cannabis Regulations

3. San Jacinto, CA

Why: San Jacinto offers one of the more creative cannabis tax structures of any city in California, with manufacturing and distribution taxed on a square footage base, rather than on gross receipts.

Uses: Retail, delivery, cultivation, distribution, manufacturing, microbusiness and laboratory testing.

Application Period: Open ended for non-retail uses.

Tax Rate: Outdoor Cultivation: Five dollars ($5.00) per square foot of cannabis related activity. Indoor: Cultivation, Distribution, Manufacturing, and Testing Laboratories: Ten dollars ($10.00) per square foot of gross building footprint utilized for any cannabis related activity (including ancillary office and other administrative areas) excluding retail sales.

About Mitch Kraemer

Mitch is a market research analyst at Cannabis Real Estate Consultants. He brings a desire for research and has a strong sense on market movements and emerging markets for cannabis real estate / business opportunities.

Mitch’s analytical mindset and the robust CREC Portal allow him to stay up to date on jurisdiction, municipality, and state changes for cannabis regulations. Mitch’s research is vital to our real estate brokerage due to his vast knowledge and understanding of upcoming or current cannabis regulations.

Contact us to for further analysis of Riverside County, Adelanto, and San Jacinto to get out ahead of the game, with the knowledge to make more effective, and less risky decisions for your expansion strategy.