Use our knowledge on the cannabis supply chain to craft your business strategy!

This article is an observation on cannabis production licenses and how the cannabis supply chain is evolving in California. Each state is its own ecosystem and closed loop system when it comes to cannabis regulations. It is no easy feat to quickly create a new and legal supply chain when the regulations continue to change.

Issues with rolling out the supply chain properly affect access to product and, ultimately, keep the black market thriving with it’s lower prices and easier accessibility.

Due to federal laws and the fact that cannabis is still considered a schedule 1 drug, cannabis products cannot cross state lines. This presents even more unforeseen challenges for each state’s production. Depending on how the state set up their regulations, sometimes a lot of product gets wasted.

Analyzing how regulations have shaken out in other states provides some valuable insights for new emerging markets like California. Everything comes back to supply and demand of the product.

So can the current cannabis supply chain keep up with future consumer demands?

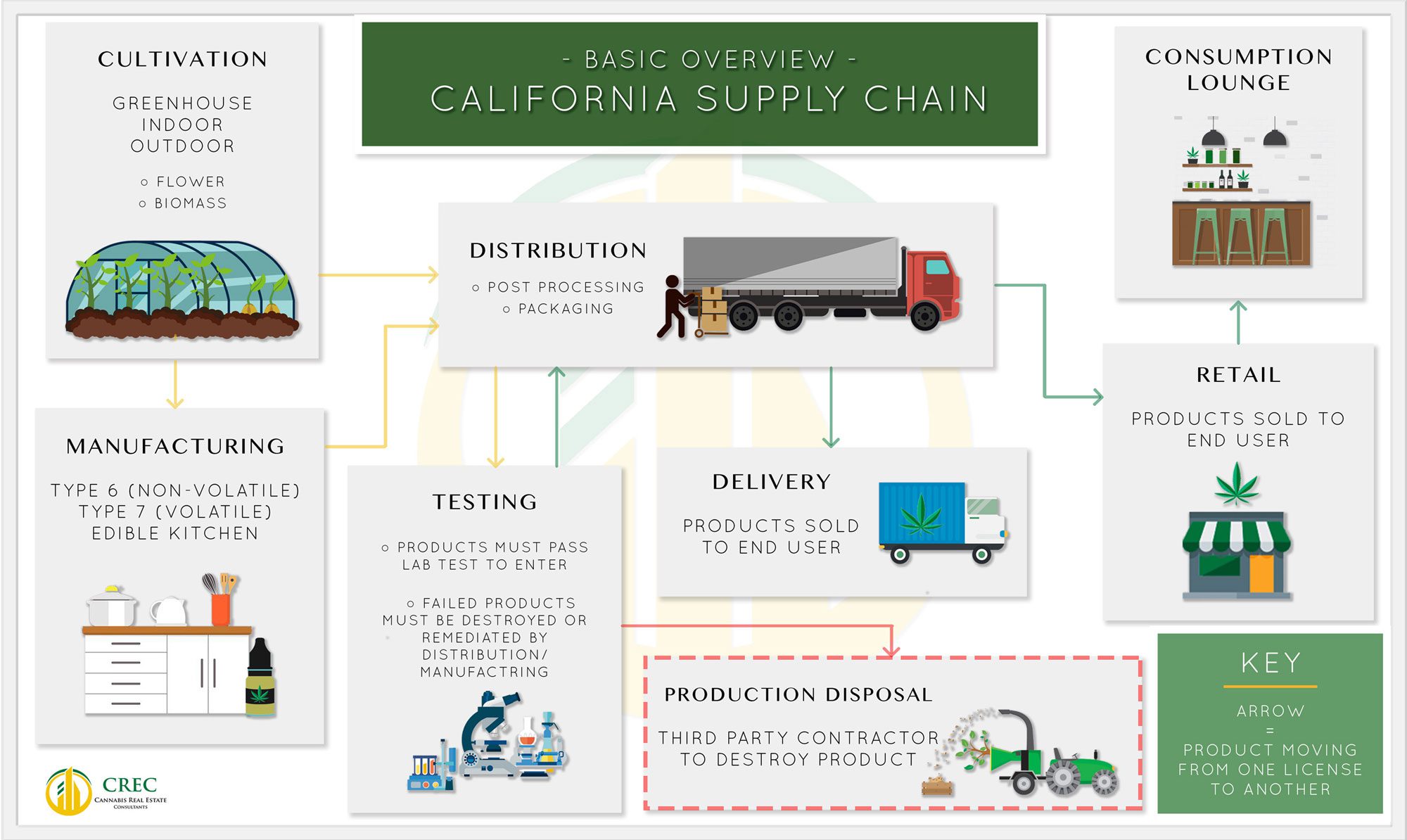

California Cannabis Supply Chain Diagram

We created this diagram after we realized there were not many examples of the full California supply chain.

Please download it, share it, and help others in the community learn how it all works.

Learn More on our Newsletter

Sign up for educational blog posts, industry analysis, and awesome property listings straight to your inbox.

How Supply Chain Regulations Shape Business Strategy

Seeing how regulations shape the production, versus retail, side of the market tells us a lot about future business strategy for license holders. Both Colorado and Oregon have had pricing issues with the way they rolled out their regulations. Here are two examples:

- Colorado launched it’s cannabis regulations in 2012, and by 2019 you could find more “dispensaries in Colorado than Starbucks, McDonald’s and 7-Elevens combined” at 550 stores. Also, due to no caps on production licenses, Colorado has seen substantial price compression on wholesale products, with more than enough production to supply demand from the market.

- In Oregon it is even worse. They also didn’t cap production licenses and this has seen flower prices recently plummet to all time lows. Many businesses are no longer operating and the production side is in a precarious desperate position. A recent state bill even presented the idea of Oregon exporting cannabis products out of state to alleviate supply and demand imbalances. Shipping out of state would clearly be breaking federal laws.

California has state regulations which must be followed, at a minimum, by everyone in the cannabis supply chain to stay in compliance.

California has state regulations which must be followed, at a minimum, by everyone in the cannabis supply chain to stay in compliance.

However, local governing bodies with regulations are able to create rules which supersede these state guidelines.

This mean sometimes the local rules can add more difficulties. Many municipalities in California still ban cannabis operations and others devised tough zoning rules for production, distribution and retail sites.

Some municipalities allow for production but no retail, as we shared recently in our post explaining how the battle for retail licenses is heating up in California. “There are currently 53 cities in California that allow some type of production use but no retail.” This creates an imbalance between available shelf space and available product.

In every other market so far, production businesses have had to battle for shelf space and it leads to lower wholesale prices eventually. That’s the risk of being only in the production side of the business and informs business strategy.

In addition to all this there are strict requirements for all cannabis goods for sale in California. Everything sold at a store must be tested at licensed labs and have a label showing the amount of THC and must be sold in child-proof packaging. At each step of the regulations being rolled out the rules around packaging and labeling has changed to create a closed loop supply chain. This means that no cannabis can divert out of the legal market into the black market.

This caused a lot of product that would’ve normally been sold on legal shelves to no longer be able to be sold until changed to meet the new regulations. Last year, just before July 1, 2018, many dispensaries all over California were selling all their product at a discount as they had to clear the shelves of packaging and products that was no longer compliant. What a great time to be a consumer– Christmas in July!

Related Reading from our Trusted Partner – dutchie POS

- Blog post: Inventory management for cannabis dispensaries explained

- Blog post: How to easily handle METRC inventory calls with the right POS

- Blog post: 10 common compliance mistakes—and how to avoid them

- Guide: Choosing a Point of Sale System for Cannabis Retail

- Cultivation, by easily organizing, managing, and tracking plants throughout their growth cycle

- Manufacturing and processing, by creating and tracking batches and formulations, defining equipment settings, and calculating product potency

- Distribution, by tracking inventory, order creation, and fulfillments with real-time inventory status updates and location information

Many Markets Now have Licensed Businesses for Sale

You can currently find many different cannabis licensed operators trying to sell their business for lower than market value prices in other markets. On a recent trip to Oregon, one of our staff saw multiple empty greenhouse operations that had halted production. In Colorado we recently saw a large scale indoor operation with permits selling for just $475,000.

You can currently find many different cannabis licensed operators trying to sell their business for lower than market value prices in other markets. On a recent trip to Oregon, one of our staff saw multiple empty greenhouse operations that had halted production. In Colorado we recently saw a large scale indoor operation with permits selling for just $475,000.

California can look to these other markets as how things might shake out here. Having no cap on production licenses lends us to think that California has the potential to go the way Oregon has, with plummeting wholesale prices in the long run. The difficulty to bring the product to market through stringent testing has also kept products off the shelf.

We find that there is limited cannabis real estate available at first in a new market but over time due to over saturation on the production side leads to eventual fire sales of these businesses because they just can’t compete. We must take a rational view of where we are currently at in the cycle here in California.

How will we Know the Effects of California Regulations?

With license holders being able to still divert products to the black market, if they need to, we won’t truly understand the true effects of California cannabis regulations until the Metrc track and trace system has been fully rolled out. There is no clear start date but rumors is it may happen as soon as July 1, 2019.

When that day comes, it will be very interesting to see how supply chain changes play out. It will take time for businesses to begin operating under the new models. No more dishing off product to the black market will mean a lot of those on production side will be forced to close their doors, as well as sell their assets and products at fire sale prices. Unless they’re able to somehow squeeze themselves onto enough shelves and sell through at the store level. This is something that is very difficult to do in any market and can take a year for a new brand to find their market at scale.

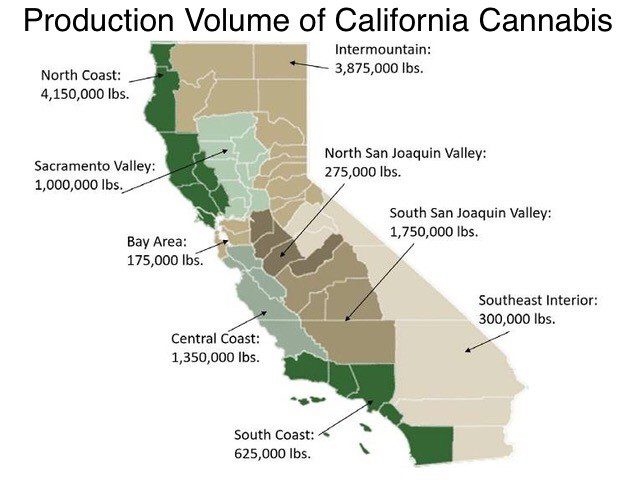

For those in the production side of the California cannabis supply chain, we would like to share an interesting observation. See this chart below:

Production Volume Unbalanced Across California

You will see that 9 million pounds of cannabis flower production is being produced north of San Francisco.

That’s an amazing 70% of the 13 million pounds of production!

With roughly two thirds of California’s population residing in Southern California, this creates an interesting dynamic for California’s cannabis supply chain.

This signals that the majority of value added services to production (manufacturing, distribution, and packaging) should be occurring in Northern California. The reason being is that it doesn’t make logistical sense to move thousands of pounds of flower and biomass all the way to Southern California for this further processing.

With price compression of wholesale products in the near future, license holders should take a serious look at how they’re handling logistics and where they should be holding their key locations to maintain lower costs.

The above information signals that distribution and manufacturing licenses should be more in demand in Northern California and if you’re one of these licenses holders looking to sell or partner with other groups, you should reach out to us to see how we can help. More on that in a moment.

What does this all mean for those with a production business?

In the long run, lower wholesale prices are going to be good for the industry. This would mean potentially lower retail prices for customers and, in turn, would mean more overall consumption/buying, and more access for all.

This process of lowering retail prices is an inevitable part of normalization that the industry needs. We can expect 5-10 years from now that cannabis retail prices are going to be less than the current market, where retail stores are still competing with the black market. This is due to high costs of staying in compliance and the high tax payments business are currently facing.

Cannabis retail prices will only be able to beat out the black market once the production side has a high enough production volume to absorb these costs and reaching economies of scale. Also, task forces eradicating illegal operations will reduce the black market competition. In turn, the less illegal operations, the higher prices you will find on the black market … meaning the legal market will become more attractive to the end user.

This inevitable price compression is a double edged sword. It presents a benefit for normalization of cannabis and gives more value to the end user for less money spent. Unfortunately it presents risk and challenges for the production side of the industry. In every market so far we’ve seen no cap on production licenses. This has left a lot of the little guys holding the bag.

Make sure to tread carefully if this is you and try to see the bigger picture. Sometimes selling your production assets before the fire sales happen is a smart move.

We acknowledge that this stuff is not easy. Good luck trying to create the perfect regulations that has the perfect balance between supply and demand so everyone that starts a business in the space is able to win. The key is to be aware of how these dynamics are shaking out and how they affect your business so you can make the right moves ahead of time.

We encourage you to look at your business strategy and think about the long term. Look at the reality of how your business will survive based on everything we’ve discussed today.

History doesn’t happen the same every time but it sure does rhyme. Maybe it’s time you explore your options.

Interested in the Value of your License?

Want to see what your license may be worth? Fill out this 2 part questionnaire and we will help you find a potential value for your cannabis license. One of our agents will follow up with you to learn more and potentially connect you with a buyer or a potential strategic partner. We’re here to help!

Let us know what you think about the future of cannabis supply chain management in California and across America. Are they doing it right? Is there room for improvement?

Thanks for reading!