The most valuable cannabis license in California is Retail.

Do you know why?

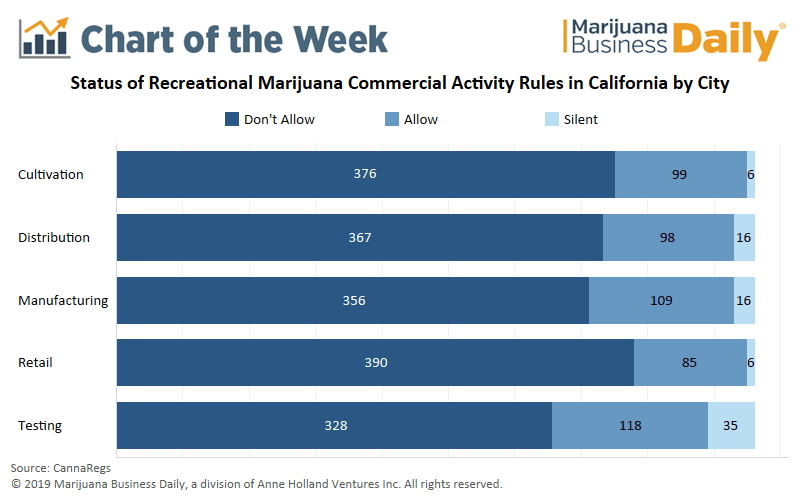

It basically comes down to the economic principles of supply and demand. Out of 481 cities in California only 118 of these allow for recreational cannabis storefronts. This means as of February 2019 there is only 25% of jurisdictions in California currently allowing for adult use purchasing.

There’s just not enough stores in relation to the demand.

With so many banned cities and new jurisdictions coming online excruciatingly slowly, it presents a situation where dispensary license values are actually increasing. If you are searching for a retail location, you can search our list of cannabis retail locations for sale or lease.

Why California Cannabis Dispensary Licenses are so Valuable.

The value of the retail / dispensary licenses are subject to supply and demand with no expectation to go down in value any time in the next few years.

In the San Diego market, there is a cap on licenses. In addition to this, the City of San Diego has so few locations because the land use restrictions are very strict. There is a small amount of allowable zones and the fact that churches are considered a sensitive use creates an inherent shortage of viable parcels in this market.

Contact us if you have a cannabis business license for sale.

Cities creating a cannabis retail ordinance that want to have enough stores to supply demand usually use the metric of allowing 1 retail license per 10,000 residents. San Diego decided to start with very strong limits in their regulations.

Because of this we’ve seen retail licenses in the San Diego market sell between $5-17 million!!!

With 1 store supplying 100,000 + residents it makes these license values sky high. Remember the above, most cities allow for 1 store per 10,000 residents when they use a ratio.

In San Francisco, a cannabis retail license is currently averaging around $3 million dollars in early 2019.

Los Angeles retail licenses are different across the board due to such a fragmented market with no clear guidance on license values.

“The competition is fierce. Both retail focused and production focused companies are battling for California cannabis shelf space.” – Rick Payne, President and CEO of Cannabis Real Estate Consultants

We’re seeing much less friction and shorter application timelines for operators trying to secure a production use (cultivation, manufacturing, distribution) license versus retail. This is because new retail stores in a city without stores currently are more challenging to get licensed.

There are many more issues like pushback from neighborhood groups, city leaders struggling to move quickly, and competition leading to appeals and more further hearings. It’s not uncommon to see a retail license take well over a year to receive.

With license holders being able to still divert products to the black market we won’t truly understand the true effects of California cannabis regulations until they kick on the Metrc track and trace system. There is no clear start date but rumors is it may happen as soon as July 1, 2019. When that day comes it will be very interesting to see how supply chain changes play out.

With thousands of production use licenses (cultivation and manufacturing) in the market, it creates a problem where there is more product than available shelf spaces. With an estimated 13 million pounds of cannabis flower production happening in California, that’s a lot of product that has to find it’s way on a store shelf or delivery menu. This issue has already been realized in Oregon with a massive amount of product that is being produced but not sold.

How many Retail / Dispensary Licenses can California Handle?

In California there are currently 640 retail licenses and 315 delivery licenses.

That’s 955 potential purchasing options for 40 million people. Keep in mind that some of these locations are retail AND delivery. This means for that each store/delivery caters to around 42,000 people per location.

With a population of 40 million people in California then we can estimate that California can handle approximately 4,000 Cannabis retail licenses to align with 10,000 people per store. And this doesn’t factor in the 250+ million tourists that visit California each year. As more adult use stores come online, that means more available locations for tourists to purchase from.

You can see why these retail licenses are so sought after…

Click to view retail properties we have available on our site for sale or lease!

Cannabis Licenses Issued in California

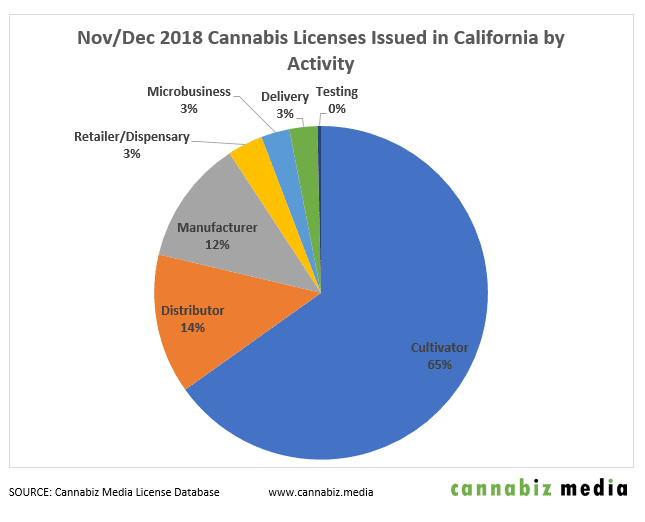

For example, there are currently 53 cities in California that allow some type of production use but no retail. As shown in this chart below by Cannabiz Media (www.cannbiz.media) there are only 3% of licenses being represented by cannabis retail use, and another 3% for delivery.

This imbalance is creating an under supply of California cannabis retail licenses relative to demand. This is only likely to increase over time with more production licenses coming online faster than retail, along with track and trace planned to be initiated at some point in 2019.

“With license holders being able to still divert products to the black market if they need to we won’t truly understand the true effects of California cannabis regulations until they kick on the Metrc track and trace system. There is no clear start date but rumors is it may happen as soon as July 1, 2019. When that day comes it will be very interesting to see how supply chain changes play out.”

Cannabis Oversupply Market Dynamics in California

Since there are thousands of production use licenses (cultivation and manufacturing) in the market, it creates a problem where there is more product then available shelf spaces.

With an estimated 13 million pounds of cannabis flower production happening in California, that’s a lot of product that has to find it’s way on a store shelf or delivery menu. This issue has already been realized in Oregon with a massive amount of product that is begin produced but not sold.

Operators in the supply chain understand the value of cannabis shelf space in California. Without it, they’re not going to be able to make any sales and face the risk of their business failing.

Currently the action is heating up with a massive amount of competition in the most desired markets.

For example, West Hollywood “received over 300 screening applications from over 120 different applicants for a limited number of licenses” related to cannabis retail where they actually granted licenses to only 20 different entities.

“With 20 groups receiving licenses, from over 300 applications, this shows the severe limited supply.” – Rick Payne, President and CEO of Cannabis Real Estate Consultants

The competition is fierce. Both retail focused and production focused companies are battling for California shelf space. Especially in areas where there is a cap on licenses, the values are skyrocketing.

Canada Enters the US Retail Market

Public companies from Canada, fresh off filing their piggy bank with cash, are entering the fray and are acquiring licenses all over California.

Sometimes they will buy multiple locations at the same time, like with the recent TerrAscend acquisition of The Apothecarium. (https://www.newcannabisventures.com/canadian-cannabis-company-terrascend-to-buy-california-retailer-apothecarium-for-118-4-million/) There was an astounding $73+ million paid in cash as a part of the transaction. The $118.4 million deal valued on $45 million in revenue represents a 2.62 x purchase value on revenue, which is on the higher end of what we’re currently seeing in the market for storefronts showing revenue.

Learn the value of your cannabis license

Are you a cannabis retail license holder interested in finding out what your business might be worth?

We have multiple clients right now ready to buy licenses with and without revenue.

Fill out a short questionnaire to see what our clients are willing to pay for your business. You will be redirected to a page where you can tell us more details about your business operations and the cannabis license you have for sale. We look forward to learning more about your business.

It will be interesting to see how things shake out for the rest of 2019 in the California cannabis retail sector. Let’s hope California goes better than other states that came before it.

Please leave your comments below.

Featured Image Source: Barbary Coast – https://barbarycoastsf.com/ , https://www.curbed.com/2015/3/30/9976266/medical-marijuana-dispensaries

Chart Sources: https://mjbizdaily.com , https://cannabiz.media/