$50 Billion a year

This outrageous number is the projected boom in the cannabis industry growth over the next ten years, according to a recent ARCVIEW Market Research report. With public opinion polls significantly in favor of cannabis legalization, this article will explain why investing in cannabis is a profitable decision…

…and why there has never been a better time to get involved than now!

However.

It’s still hard to navigate just where the money should be dedicated as well as wading through the changing legalities of various states. There are so many opportunities to invest in cannabis, from cultivation/growers, to edible manufacturers, to hemp products that can change the world, and medicines, dispensaries, etc.

TABLE OF CONTENTS – Our best advice on cannabis investing in the USA:

- How is investing in cannabis profitable right now?

- Why should I invest in this growth?

- Are there any risks to cannabis investments?

- Why do we recommend cannabis investments?

Investing in cannabis stock options has been an attractive choice the past few years, so you may be asking…

What is the best cannabis stock to invest in?

GW Pharmaceuticals (NASDAQ:GWPH), is a company that makes drugs derived from cannabis and is up nearly 1,200% in just under four years. A company, “Medical Marijuana” has also had instances of rising up to 1,000%.

GW Pharmaceuticals Stock Chart

However, nearly every single marijuana stock is currently losing money, and getting up-to-the-minute information about them is very difficult.

Let’s take a lesson from our country’s history books on prohibition and the re-legalization of alcohol to give us clues on market trends. Imagine, right before prohibition was lifted in 1932, you knew that the production, sale, and transportation of alcohol would become legal. How would you invest your money in alcohol?

Present day, we are facing an almost complete parallel with investment opportunities in cannabis. What do all these opportunities need in order to thrive?

A location to operate that passes regulations for cannabis operations.

HOW IS INVESTING IN CANNABIS PROFITABLE RIGHT NOW?

Investments in cannabis real estate is the most profitable venture you could make at this time.

With numerous risks still present in the cannabis industry, we want break down just how profitable it is to invest in cannabis by focusing on a safe bet: real estate.

Owning real estate is a controllable variable amid various methods of investments, with familiar tried and true results. It’s a safer way to entrust your money in this lucrative business.

Owning real estate is a controllable variable amid various methods of investments, with familiar tried and true results. It’s a safer way to entrust your money in this lucrative business.

Property values have skyrocketed since 2013, according to a recent article in the New York Times, as cannabis entrepreneurs are transforming their spaces into suitable plots for their needs.

Often times, cannabis business owners end up footing the bill for costly transformations of properties for CUPs, which is a an expensive situation to deal with for any owner of a cannabis business, but not for the property owner. In fact, it’s a good way to get your property up to code.

High demand with limited supply

Many “potrepreneurs” are shifting away from owning dispensary businesses in order to invest in the 420-friendly properties themselves. Recently there has been a shift of focus to real estate, as opposed to dispensaries, because cannabis properties are in extremely high demand with limited supply.

Legalization of adult use in California is set to commence January 1st, and the time couldn’t be better to start investing. It is not rare to see a $3 million estate sell at up to $8-10 million if the zoning regulations are adhered to. Commercial properties zoned for marijuana businesses are not the only ones seeing property values soar.

Most residential markets that can handle home grows have had an effect on home values. A real estate agent working with homeowner hopefuls with this in mind, says the real estate explosion in California has shown growth of 13 percent in the last year, and a house under $300,000 could sell for 103 percent of the asking price, sometimes with 30-40 offers on the table to choose from.

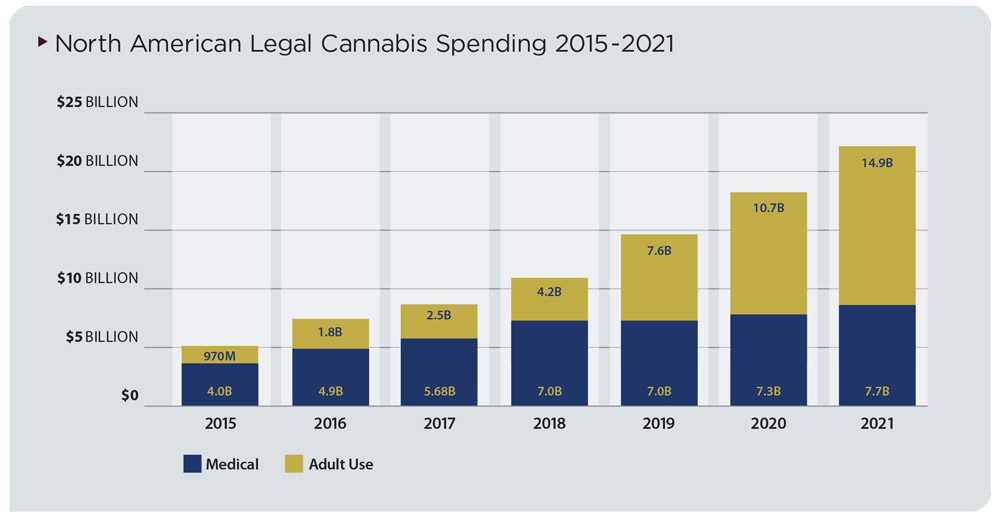

Spending on adult-use “recreational” marijuana is expected to surpass medical marijuana in 2019

WHY SHOULD I INVEST IN CANNABIS GROWTH?

With the current $6.7 billion legal cannabis market projected to grow at 27 percent annually over the next five years, brick and mortar investments are beating out the retail business because it doesn’t “touch the plant” and it’s viewed as a safer way to make money from the outrageous growth.

In cities that legalized production, prices of industrial spaces used for cannabis purposes have doubled, and sometimes tripled immediately after the laws passed.

We are witnessing an epic Green Rush, with all the fervor and drool of the California Gold Rush. But just as investors back then made more money backing shovels instead of investing in gold itself, investors should look outside the box and see that real estate financing is where the boom will have the most lasting growth.

Timing + Location

It’s important to note that the timing of when to buy is just as important as location when it comes to cannabis. Becoming familiar with which laws have passed, which cities are getting ready to vote on adult use, what the zoning restrictions are or what conditional use permits are needed are all important in getting the most return.

Finding a company experienced with investing in cannabis is crucial. We’re happy to help!

One cannabis business owner making the shift to cannabis real estate investments worked to pass a city ordinance in a small city in California to allow for cultivation. Before anyone in the city knew about the cannabis cultivation law, they scooped up seven parcels of land for around $325,000. After the law became public two months later, the owner sold the property for around $1.8 million to excited cannabis business owners.

“The legal cannabis market was worth an estimated $7.2 billion in 2016 and is projected to grow at a compound annual rate of 17%. Medical marijuana sales are projected to grow from $4.7 billion in 2016 to $13.3 billion in 2020. Adult recreational sales are estimated to jump from $2.6 billion in 2016 to $11.2 billion by 2020.” – New Frontier Data Report

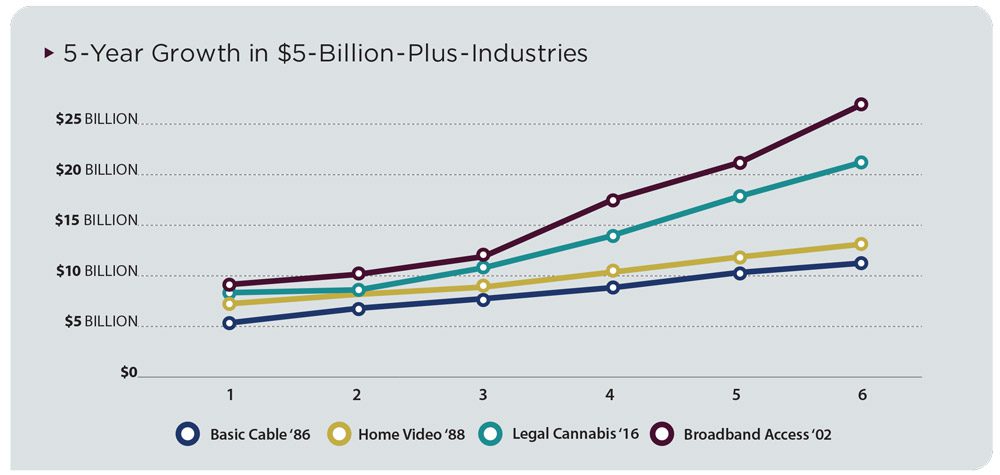

This report shows cannabis growth compared to other fast growing industries of the past

Not only is the cannabis industry good for investors, property values and residential home values, the industry is predicted to surpass the general manufacturing industry in job creation within just 3 years, according to Forbes. Local economies for cities with cannabis legalization laws in place are set to boom if they stay on track with these projections.

Sign up with CREC as an investor to learn more about the cannabis laws in your interest area and connect you with an expert in cannabis investments.

You’ll find that having a trusted cannabis license application team on your side will make a large difference in supporting a successful transaction.

ARE THERE ANY RISKS TO CANNABIS INVESTMENTS?

All that glitters is not gold in this Green Rush.

As with any investment opportunity, the cannabis industry comes with risks. It’s an industry that is still federally illegal, not supported by the current Administration, and mostly uses cash.

Government regulations seem to have the most swing on profit margins for marijuana businesses. The industry is reliant upon zoning laws, licensing caps, and taxation.

Taxation alone could cripple a company, due to federal tax laws prohibiting any cannabis-related deductions. Theoretically, a dispensary could be 100 percent compliant with operations and have absolutely zero profitability due to a tax rate of about 40 to even 70 percent.

The fact that marijuana is still considered a Schedule I drug (meaning that the federal government does not believe that it has therapeutic use, and a high potential for abuse) is and will remain the biggest risk for anything related to investing in cannabis .

So even though 28 states (as of Nov. 2017) have now voted and passed laws on adult and medicinal use of marijuana, the federal government can still shut down a business for it’s association with the plant.

However, federal enforcement of these laws does not appear to be a huge priority, and in California, there are no more federal resources to enforce those laws, leaving it a “sanctuary state” for cannabis businesses.

Many of the current concerns come from statements made by Attorney General Jeff Sessions, who has been quoted saying, “I reject the idea that America will be a better place if marijuana is sold in every corner store. And I am astonished to hear people suggest that we can solve our heroin crisis by legalizing marijuana–so people can trade one life-wrecking dependency for another that’s only slightly less awful.”

President Trump, however, doesn’t appear to share Sessions’ distaste for the industry, expressing support for individuals to make up their own mind about adult use of marijuana. The contradiction between federal and some state laws creates a legal grey area within to work, meaning investors need knowledgeable cannabis partners and cannabis consulting companies who understand this industry inside and out.

Trump’s disinterest in shutting down the cannabis boom in the U.S. may have something to do with the incredible numbers projected from global markets. A recent Forbes article predicted the U.S., is set to be number one in the global market for cannabis. Even as other countries become more and more liberal with their cannabis laws, the U.S. will be the country to beat.

WHY DO WE RECOMMEND CHOOSING CANNABIS INVESTMENTS?

It’s a huge underground industry and only getting bigger with legalization. Every day, more and more investors are choosing to get into the cannabis industry on the ground floor.

The ArcView report says it has 625 investor members who’ve put over $100 million into 137 different cannabis companies.

“We’re seeing a ‘land rush’ for light industrial warehouses,” says Mikalonis, legislative advocate for the cannabis industry at K Street Consulting. “The biggest demand is for cultivation space. Prices for warehouse space have skyrocketed over the last 12 – 24 months, based on cities going legal.”

Out of the myriad of ways one could put money into this industry, real estate is proving to be the safest and most profitable way with fast returns. Simply put, investing in cannabis with real estate is the missing link to many business’s growth.

$50 Billion.

That number should get anyone’s heart pounding. Licenses to grow, cultivate, sell, and manufacture cannabis products are all usually tied to a specific property.

Almost every aspect of this industry starts with the business location. An investment at this time means being at the core of the cannabis industry. If you are an investor looking for an opportunity, or just have questions, we hope you will tell us more information about your investment goals and sign up to learn more.

Sign Up To Invest In Cannabis With CREC

We specialize in finding real estate opportunities for investment within the cannabis industry. Sign up to get started and tell us more about your investing profile. We look forward to hearing from you.

Only accredited investor submissions please.

You can also join our newsletter to get up-to-the-minute news about cannabis real estate and exciting investment options. Staying on top of the legal and local trends in the cannabis industry is what makes the difference between an investor and a wealthy one. Happy searching!

Related posts

Cathedral City Ends Cannabis Moratorium with Odor-Focused Rules: What Operators Need to Know

CREC Network Member Success Stories – October Update

Upcoming California Cannabis Markets to Watch in 2023

3 comments

Wendy McCormick

$50 Billion a year – this rate will soon be 420, if you understand what I mean)

Buy Marijuana Seeds

Investing in cannabis industry is truly a wise and profitable choice. This article would help you to make a wise decision . Thank you for posting such an interesting article . I’ll surely come back here and read more of your knowledgeable and informative article. Keep on posting.

Wade Joel

I’m glad you talked about the importance of becoming familiar with which laws have passed, zoning restrictions, and conditional use permits. I am currently interested in investing in the cannabis business and I wasn’t considering these things. I will be definitely looking for a company for assistance but your article helped me get a wider idea of what the whole process and business consist of. Thanks!