Learn your options for cannabis payment solutions, your current limitations, and most importantly how you can increase your revenue by up to 21% by offering a credit card payment method!

Join our CREC Directory Partner, Integrity Payment Processing from June 30th, 2021, where we discussed the complicated question of “How can I accept credit cards?”

We will discuss multiple ways to collect credit cards, what not to do, how to choose for your business, and how you too can create a paypal style solution but for cannabis payments.

About Livia Caudell

Livia Caudell is the CEO of Integrity Payment Processing and has done extensive research, compiled solutions, and is ready to fight on your side to prevent issues with payment processors.

“My company’s name is Integrity Payment Processing. I stand behind “Integrity” as being our number 1 core value that we operate from. Our customers are not just a number, they are treated as an extension of our community and family. We pride ourselves on guaranteeing the lowest rates, giving 5 star customer service, and we are 100% transparent in pricing & fees.”

At Integrity Payment Processing, they understand that the old “cookie cutter” approach to debit and credit card processing just doesn’t work in today’s marketplace. The electronic payments field is not a one-solution-fits-all industry. That’s why they work hard to understand your unique payment processing needs and customize the best solution for your business to grow and thrive.

You can also read top tips on credit card processing, from interview with Livia, after the video!

VIDEO RECORDING: How to Accept Credit Card Payments as a Cannabis Business

Moderated by Roger Tower, Chief Marketing Officer, Cannabis Real Estate Consultants.

How Can Accepting Credit Card Payments as A Cannabis Business Increase Revenues?

Simply put, when a consumer is able to use multiple other forms of payment in a transaction, they are more likely to spend more, in comparison to withdrawing a certain amount of cash.

Livia explains that there are 5 ways you can accept credit card or e payments in your cannabis business, and when you work with Integrity Payment Processing you have someone to trust that your transactions are being handled securely and you as a merchant are the most important.

“Truly with my company, I have my clients back, not the merchant providers. So I go to bat for you as the merchant, make sure you get the best deal. You get the best rates and everything is…transparent, the pricing, no hidden fees.”

Ask Livia Question about payment processing options for your cannabis business

3 Ways to Accept Credit Cards in Cannabis

1. Stable Coin – USDC, AKA, Digital/Electronic Payments

This is a tokenized solution where your customers are using a credit or debit card either in store or online and as soon as the money is pulled from that card, it immediately converts to USDC which is the stable point. Yes, it is a cryptocurrency, but there’s a distinction.

This is a tokenized solution where your customers are using a credit or debit card either in store or online and as soon as the money is pulled from that card, it immediately converts to USDC which is the stable point. Yes, it is a cryptocurrency, but there’s a distinction.

USDC is dollar for dollar, so there is little variance if anything and they do same day conversions and use federally chartered banks. This is the same as cash apps like Zelle or Venmo and they use the same technology. Unlike cryptocurrency, there are no wild swings up and down.

The benefits of using Digital/Electronic Payments include 72 hour funding, digital retail payment solutions for transactional in-store purchases, an E-commerce credit card payment solution for kratom sales, Nutraceuticals and other high risk transactions, payment support and management experts. With this method your company is able to accept VISA, Mastercard, and Discover cards, have an API plugin, no reserves, and the ability to make smarter pricing and inventory decisions and increase sales by offering digital payments.

One of the benefits, having no reserve, is pretty awesome. It means you’re getting 100% of your profits minus the merchant fees which is pretty unbeatable.

The terminal is very modern and sleek, and is multifunctional with SIM chip technology, WiFi capability, a direct ethernet port, an Android 7.0 operating system, a dual touchscreen, a 3 inch thermal printer, 4G/3G/2G network capability, a NFC/magnetic stripe card reader, a 1D and 2D scanner, and a LAN/USB port. This can scan IDs during the checkout process for compliance purposes too!

In a retail environment, the customer can simply use their VISA, Mastercard, or Discover and swipe their card. It will immediately convert to a stable point and during this time the customer will give you their cell phone number to do an SMS verification.

One great thing about it being converted to a stable coin is that it is difficult to do a chargeback. If there is a chargeback, the payment provider is going to do an immediate refund which really helps you as well since you have the customers phone number you can easily reach out to them regarding their issues.

Ask Livia Question about payment processing options for your cannabis business

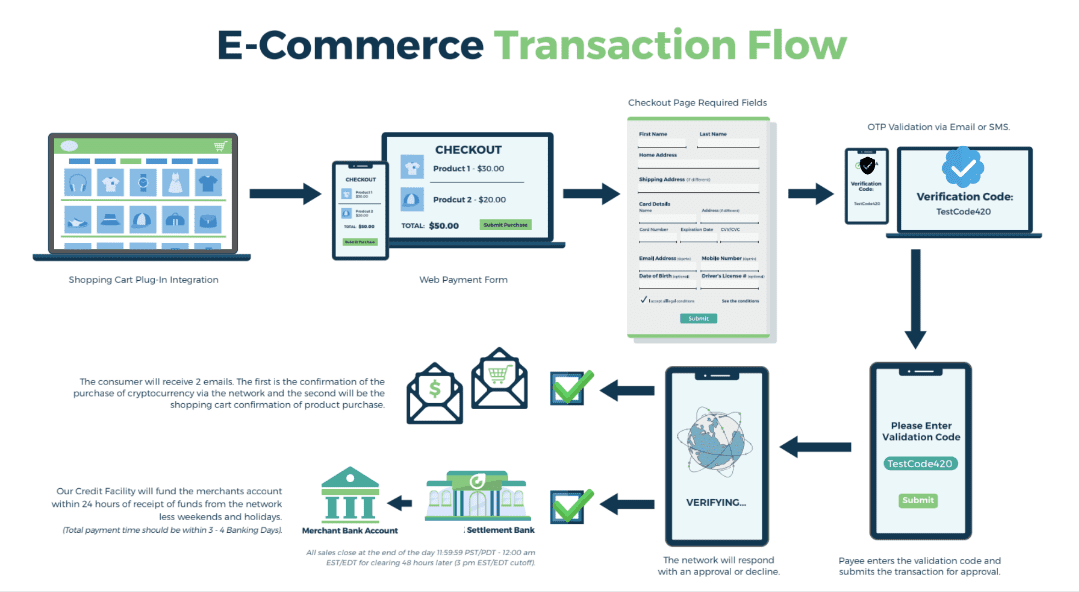

The flow of a retail transaction is shown here:

2. Text To Pay

The Text To Pay solution needs no terminal or machine since everything is done on an online portal that you as a merchant have access to to take payments over the phone or in person.

Above all, the focus is on the consumer. Simplicity, privacy, and accuracy are why Integrity Payment Processing has such a high adoption and participation rate. Consumers have a complete suite of services and statements show account balance, loaded money, statements, and a way to invite friends.

When texting to pay, the consumer will receive a message to validate their account with a simple OTP (one time pin) code. Once the customer has texted the OTP code, the staff will validate the phone number for the consumer and enter in the exact amount from the point of sale and the consumer will receive an approve/decline message in real time. The OTP really helps keeping charged backs low.

Customers don’t even need to create a login. When they go to the app, they will get a website link which is basically their account. Customers can then pay out of a debit olr credit card in $5 increments. All loads are in $5 increments and transfers are to the penny, so if the charge was $32, it will take $35 and leave $3 in the account for future purchases. They also have the option to leave a tip for budtenders right on the app.

Once the OTP is put in, the staff will see the payment and the account found to match. The staff will put in the customers first and last name, email, cell phone number, and the balance. If the customer is a repeat customer, the staff can just look up their phone number without putting in the information again. It will have their credit card number saved with all of their details, so the staff only needs to quickly input the amount they are purchasing.

The robust administrative portal offers all the administrative tools necessary to effectively manage your entire organization. You can view your business statements, which provides a complete picture of transactions, available balances, and ACH and P2P transfers in real time. Other features include managing returns and protecting your company against fraud, and a business checkbook where you can write checks for print, email, and remote deposit capture.

You can also set up and manage sub accounts, devices, and permissions at each location. The sub accounts are awesome because if you have multiple drivers they will each have their own sub accounts so they don’t see all the business that is being done.

Making sure that you are using a Compliant system, the checking account is used exclusively inside the closed loop system. Consumers fund that account with any vehicle other than cash, and it provides a distinct separation between the purchase and the transaction.

Ask Livia Question about payment processing options for your cannabis business

3. Pay with App/QR Code

Consumers can use a contactless, mobile payment platform for the Cannabis Industry to send guaranteed payments directly into your merchant account.

This app is very similar to Venmo or Paypal, but is specifically designed for the cannabis industry. With an app or QR code consumers can quickly deposit funds into their account using a variety of methods including Credit Cards and/or Debit Cards, ACH, Wires or Checks, and Cash. Merchants can also generate more revenue by offering more ways for consumers to pay and improve efficiency with the ability to take mobile payments in store, curbside, or at delivery.

This app is very similar to Venmo or Paypal, but is specifically designed for the cannabis industry. With an app or QR code consumers can quickly deposit funds into their account using a variety of methods including Credit Cards and/or Debit Cards, ACH, Wires or Checks, and Cash. Merchants can also generate more revenue by offering more ways for consumers to pay and improve efficiency with the ability to take mobile payments in store, curbside, or at delivery.

Payments are possible in minutes by downloading the app and opening their consumer account with Herring bank. Funds are quickly deposited to their account and they can make a guaranteed electronic payment from their account to approved merchants.

The app based payment system uses 128 bit transaction encryption during the purchase authorization to make safe an secure transactions. A QR Code payment process produces a unique QR Code for each transaction and requires a specific response from the Merchant Terminal for transaction security. The bank is a technology bank that has experience working with cash-intensive businesses and each merchant that is approved to accept the apps payments will have an FDIC insured commercial bank account.

This solution has a straightforward cost structure that offers merchants tiered pricing for increased transaction volume. Another benefit of this solution is that support is just one-click or call away and consumer issues can be resolved right away in the app. Merchants can even request assistance through a 24/7 customer support line or web-based ticket system.

Bonus Option! E-Check and MRB Friendly/FDIC Insured Banking Solution

There are two other simple solutions!

As long as you have a domestic banking account, you can get approved to accept payments via E-Check. And there is the option of MRB Friendly/FDIC Insured Banking Solutions.

Free Consultation on Payment Processing Options for Cannabis Business

Use this form to schedule a free consultation on how to properly setup your business to accept credit cards, have reliable banking, and have a partner ready to fight for your business with the payment processors. Fill out your info and we’ll make the introduction for you.