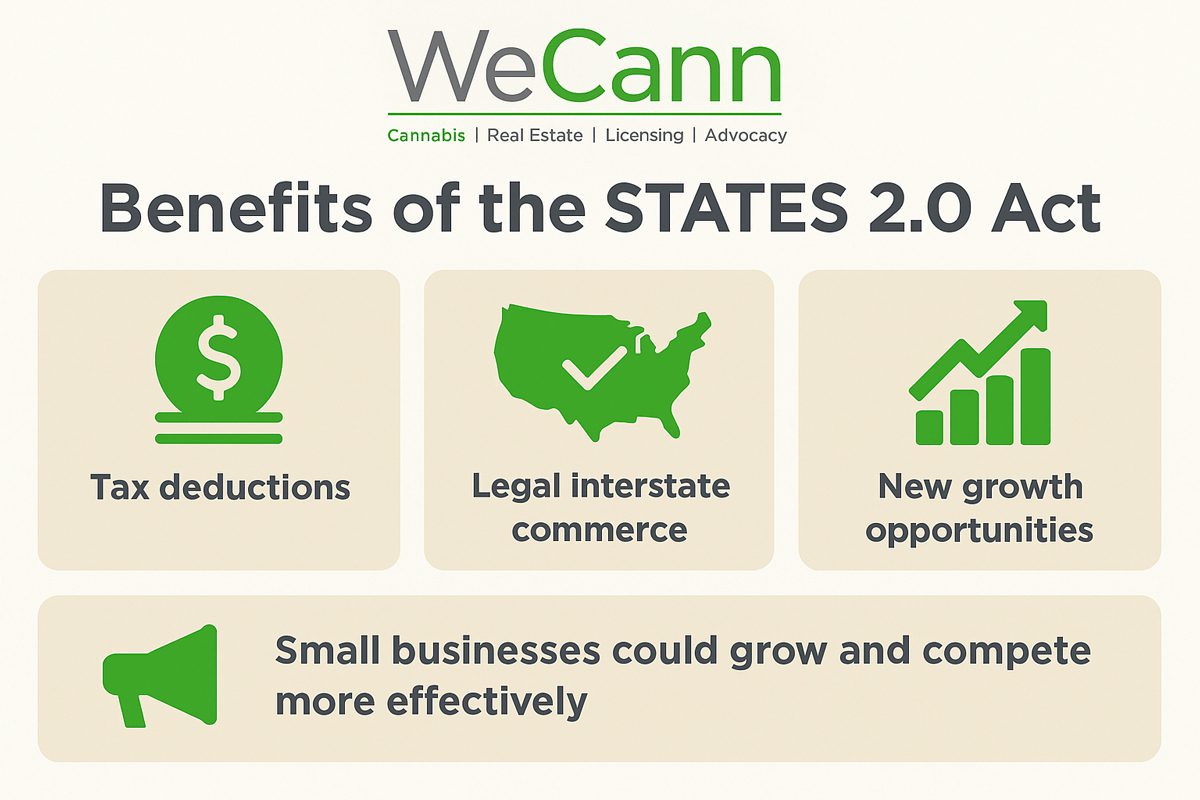

The STATES 2.0 Act, introduced by U.S. Representatives Dave Joyce from Ohio, Max Miller from Ohio, and Dina Titus from Nevada, is a bipartisan effort to modernize federal cannabis policy. At its heart, the bill would reinforce states’ rights to regulate cannabis without federal interference. But beyond affirming state authority, it proposes two important reforms that could immediately reshape the financial future of cannabis businesses across the country: tax code relief and the legalization of interstate commerce.

If passed, the STATES 2.0 Act would not just signal a shift in federal attitude. It could become a survival lifeline for thousands of cannabis businesses struggling under today’s crushing regulatory and economic pressures. Understanding what is at stake and preparing for it now could make all the difference.

Ending 280E Penalties: What It Means and How to Prepare

Today, cannabis businesses are severely handicapped by Section 280E of the Internal Revenue Code. This provision prohibits businesses that “traffic” in Schedule I substances from deducting ordinary business expenses such as payroll, rent, utilities, marketing, insurance, and professional services. As a result, many cannabis companies face effective tax rates as high as seventy to eighty percent, forcing even profitable companies to operate at a loss.

If the STATES 2.0 Act removes 280E penalties for state-legal cannabis companies, the impact would be immediate and profound:

- Businesses would be able to deduct legitimate expenses like any normal enterprise, substantially lowering their taxable income

- Cash flow would improve, freeing up funds to reinvest in hiring, benefits, technology, compliance, and marketing

- Smaller, independent, and minority-owned businesses would have a much better chance to compete against the large multi-state operators who currently dominate many markets

Steps You Should Take Now for Ending 280E Penalties

Organize your financial records carefully. Start auditing your accounting systems today so you can immediately maximize legitimate deductions if 280E relief passes.

Meet with a cannabis tax professional. Start developing a tax strategy now rather than later. Tax experts expect that the IRS will issue updated guidance following any major legislative change, and early planning will give your business a major advantage.

Run cash flow projections. Model different scenarios for your business under post-280E conditions. Knowing how much free cash you could generate will help you prepare a reinvestment strategy.

Think about your workforce. With better cash flow, businesses that invest early in employee development and retention will be better positioned to grow and succeed.

Legalizing Interstate Commerce: A Game-Changer for Scale and Survival

The STATES 2.0 Act also proposes allowing cannabis to move legally across state lines between markets that have legalized its use. This would transform the cannabis industry in ways few other changes could.

Today, operators must grow, manufacture, and sell cannabis within the same state because of federal prohibition. That reality forces businesses in saturated markets, like Oregon and California, to deal with devastating price collapses caused by oversupply. Meanwhile, states like New York and New Jersey are struggling with product shortages and inflated prices because in-state production is still ramping up.

Interstate commerce would allow the industry to function more like traditional agriculture, manufacturing, and retail sectors. It would create more balance across the supply chain and open new paths for growth.

The potential benefits include:

- Oversupplied states could export surplus product to states where supply is limited, stabilizing prices for growers and manufacturers

- Consumers would gain access to a broader range of products and brands, improving choice and competition

- Businesses could centralize cultivation and production to lower costs and improve efficiency

Other Factors to Consider: Timing, Risks, and Caution with STATES 2.0

While the STATES 2.0 Act represents a major step forward, passing it through Congress is far from guaranteed. The cannabis industry has seen federal reform efforts stall in the past, even when they had bipartisan support.

Businesses should remain cautiously optimistic. Prepare for change, but do not assume it will happen overnight.

Stay aware of the following:

- Monitor legislative progress. Pay attention to where the bill moves in Congressional committees, especially in Judiciary and Ways and Means. Watch if the bill gets attached to broader spending or criminal justice legislation.

- Understand state decisions. Even if federal law allows interstate commerce, states must opt in. Some states may choose to restrict or delay interstate activity to protect their own in-state markets.

- Watch for IRS updates. Once any 280E changes occur, the IRS will likely issue new tax reporting guidance specific to cannabis businesses. You will need to be ready to adapt quickly.

Understanding the STATES 2.0 Act: What Businesses Should Know Right Now

While the STATES 2.0 Act represents a significant proposal with the potential to reshape cannabis policy at the federal level, it is important to recognize that there is still a long road ahead before any changes become law. Over the years, many cannabis reform bills and initiatives have been introduced in Congress. Despite growing bipartisan support, most have faced substantial hurdles and have not advanced to full passage.

At this stage, the STATES 2.0 Act is a proposal. Much remains uncertain, including how it will move through legislative committees, whether it will gain sufficient support in both chambers of Congress, and what modifications might occur along the way. For now, it is essential to stay grounded in the facts we know today, rather than making assumptions or premature business decisions based on what may happen in the future.

We recommend that businesses continue monitoring developments closely but remain cautious about implementing major operational changes until there is clearer movement toward enactment. Staying informed without overreacting is critical in navigating an industry where legislative landscapes can shift rapidly.

That said, this is an appropriate time to begin internal discussions about how potential changes could affect your specific business model, tax planning, operations, and market strategy. Early awareness can offer a competitive edge when the time comes to act.

Contact Us for More Advice

If you are interested in discussing how potential reforms like the STATES 2.0 Act could impact your business — and how we can help you be better positioned for these types of market shifts — we encourage you to reach out to our team. We are committed to providing thoughtful, tailored guidance that helps you plan ahead without exposing your business to unnecessary risk.

By taking a measured and informed approach, businesses can be ready to adapt efficiently when meaningful changes occur, without getting ahead of the realities of today’s regulatory environment.